How to Build the Best Crypto Portfolio Allocation in 2023

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Creating a diversified crypto portfolio is crucial, considering how volatile and speculative this trading industry is.

In this regard, a well-diversified portfolio should contain a wide variety of crypto assets across many different niche markets. The purpose of this guide is to explore the best crypto portfolio allocation for risk-averse investors.

Best Crypto Portfolio Allocation Summary

Holding a diversified portfolio of cryptocurrencies will ensure that investors avoid becoming over-exposed to a small number of coins. This means that if one project doesn't quite perform as well as expected, other coins within the diversified portfolio could help cover the losses.

Therefore, the overarching purpose of crypto portfolio allocation is to spread the risk across many different projects. First and foremost, investors should ensure that their portfolio allocates funds to established, large-cap cryptocurrencies.

Bitcoin and Ethereum represent good options here. At the other end of the scale, investors might also wish to allocate funds to newly launched projects with a smaller market capitalization. This offers investors the opportunity to target higher gains.

Examples here include the likes of Tamadoge - a newly launched P2E crypto gaming ecosystem that recently raised $19 million in presale funding. Another angle to take is to diversify into other crypto asset markets entirely, such as relevant stocks or even interest accounts.

Ultimately, the key takeaway is that the more high-quality assets there are in a portfolio, the more risk-averse it is in the long run. Just remember, even allocating a small amount of capital to higher-risk projects can work out favorable long-term, providing the portfolio is well-diversified.

Best Cryptocurrencies to Add to Your Portfolio

As noted above, the best crypto portfolio allocation strategies will ensure that a portfolio is diversified across many different types of digital assets.

In this section, we offer some insight into how a well-diversified portfolio might allocate its funds.

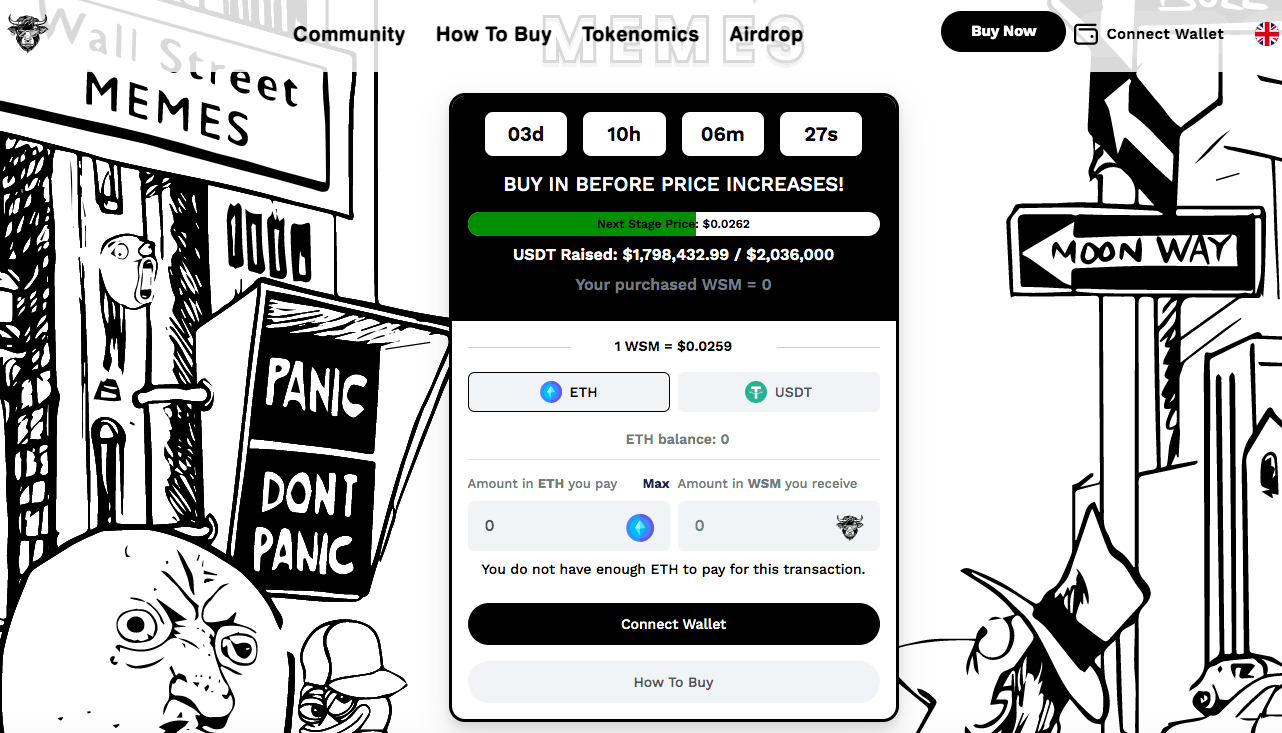

1. Tamadoge - Newly Launched P2E and Metaverse Project

A well-diversified portfolio will typically hold both small and large-cap coins. Regarding the former, Tamadoge could be worth considering for those wishing to allocate funds to a high-growth project. Founded in 2022, Tamadoge is building a metaverse gaming platform that enables players to win real-world rewards.

The game focuses on a virtual Tamadoge pet, which needs to be minted via the Ethereum blockchain. The randomization process supported by smart contract technology means that each and every Tamadoge pet is unique from the next. The rareness of each pet will be determined by the NFT's traits.

Players will need to train and feed their virtual pet to ensure that it continues to increase its strength and broader capabilities. For example, Tamadoge pets can enter battles with other players, with the winner rewarded in TAMA tokens. It will also be possible to mint new Tamadoge pets by breeding NFTs.

The team at Tamadoge aims to offer their gaming platform alongside immersive experiences. In addition to metaverse encounters, Tamadoge players will also be able to enjoy augmented reality features via a mobile gaming app. Tamadoge recently completed one of the best crypto presales in recent years - raising over $19 million in under two months.

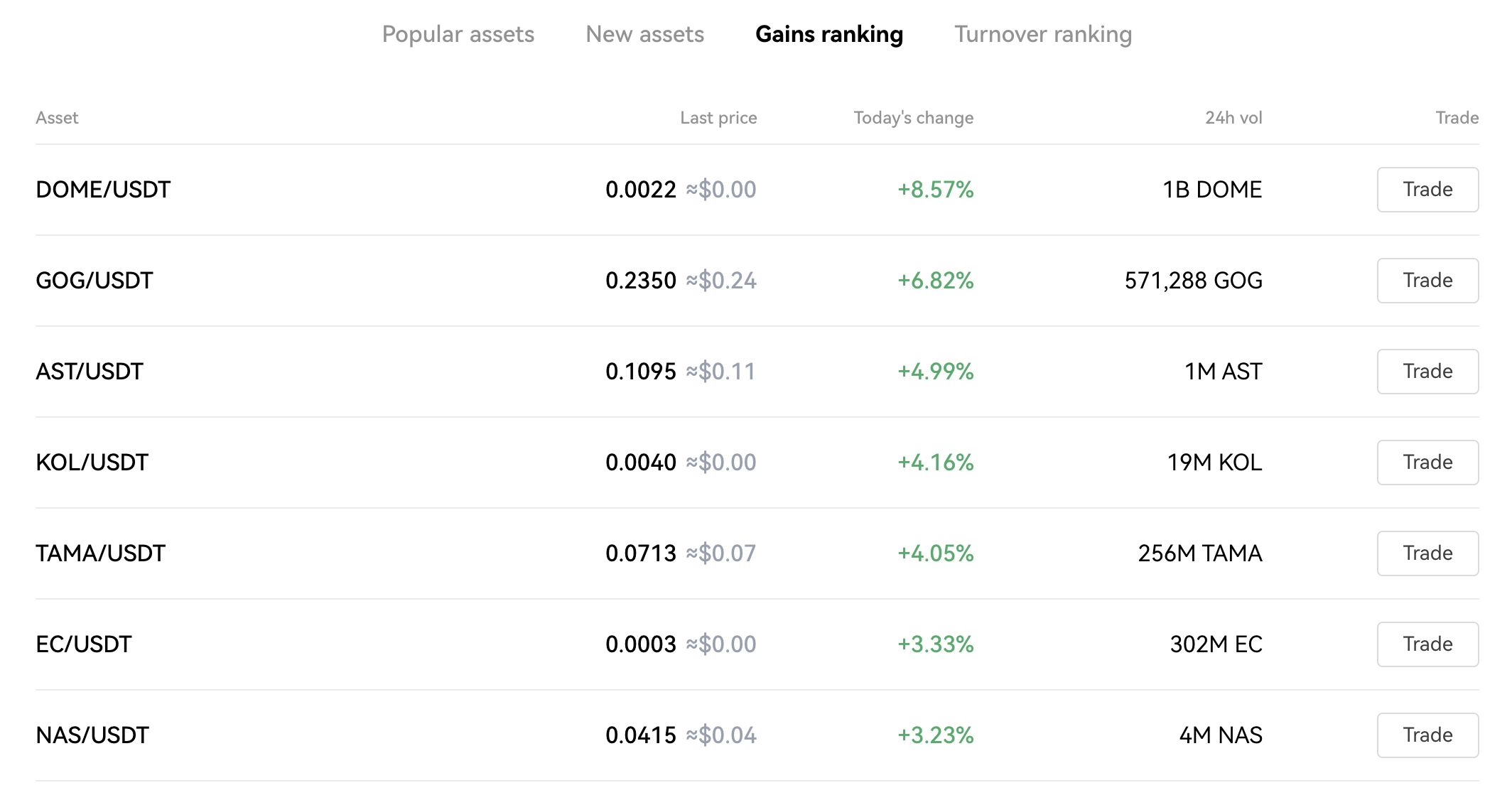

Not only that, but those wishing to buy Tamadoge tokens can now do so via the tier-one crypto exchange - OKX. This means that the project will attract vast sums of liquidity across both its centralized and decentralized exchange platforms. In addition to being one of the top trending crypto projects in the market right now, Tamadoge is still a low-cap coin.

As of writing, for example, CoinMarketCap notes that Tamadoge carries a market capitalization of under $70 million. Even more interestingly, however, is that Tamadoge is one of the fastest growing crypto assets, even though the broader industry is in a bear market. For instance, since listing on CoinMarketCap, TAMA has increased by more than 315%.

This means that when attempting to execute the best crypto portfolio allocation possible, only a small portion of the investment capital needs to go into high-growth projects like Tamadoge. For portfolio balance, the enhanced risk-reward profile can be countered by larger-cap coins.

2. Bitcoin - Best Crypto Asset for Risk-Averse Portfolio Allocation

On the complete opposite spectrum of Tamadoge is Bitcoin - the largest and most valuable crypto asset in this space. Crucially, although Bitcoin will arguably grow at a slower pace in comparison to the best altcoins in the market, the de-facto cryptocurrency offers some much-needed portfolio stability - at least in the long term.

At its peak, when Bitcoin hit an all-time high of over $68,000 in November 2021, this digital asset was worth more than $1 trillion. The valuation of Bitcoin has since declined by 70% from its prior peak. However, this offers a superb opportunity from a cryptocurrency asset allocation perspective, as Bitcoin can be purchased at a huge discount.

Rather than allocating capital to Bitcoin in one lump sum, risk-averse investors might instead consider a dollar-cost averaging strategy. This means buying a small amount of Bitcoin each week or month at a fixed investment stake. In doing so, each purchase will attract a different cost price, which will be averaged out over time.

Another reason why investors might consider allocating a large weighting to Bitcoin is that the crypto asset is limited in supply. Just 21 million Bitcoin will ever exist, which makes the cryptocurrency a scarce asset. Moreover, the circulating supply of Bitcoin is fixed and predictable, with new coins being minted every 10 minutes.

Cryptoassets are highly volatile and unregulated. No consumer protection. Tax on profits may apply.

3. Ethereum - Largest Smart Contract Blockchain With Thousands of ERC-20 Tokens

Behind Bitcoin, Ethereum is the second-largest crypto asset in this space. And therefore, this is another project to consider when evaluating the best crypto portfolio allocation strategy. As of writing, Ethereum carries a market capitalization of over $150 billion. However, just like Bitcoin, the value of Ethereum has declined considerably since the bull market peaked in late 2021.

In fact, when compared to Ethereum's all-time high of almost $5,000, the crypto asset is trading at a discount of 70%. This once again offers an attractive entry price when investing in Ethereum. In terms of longevity, although there are other competitors in the smart contract arena, Ethereum is the de-facto blockchain network in this regard.

To illustrate this point, there are many thousands of altcoins built on top of the Ethereum blockchain - otherwise known as ERC-20 tokens. This is because Ethereum is a trusted network that is renowned for its security and efficiency. This is especially the case now that Ethereum has completed its much-anticipated 'merge' to proof-of-stake.

This will benefit Ethereum and ERC-20 tokens greatly, as transaction fees are now lower and speeds are much faster. Moreover, Ethereum is now more scalable, which will potentially attract even more projects to its ERC-20 framework. Many of the best upcoming ICOs are Ethereum-based too, which offers even more demand for its decentralized smart contract services.

Cryptoassets are highly volatile and unregulated. No consumer protection. Tax on profits may apply.

4. Battle Infinity - High-Growth Play-to-Earn and NFT Gaming Platform

With the portfolio now solidified with large-cap projects like Bitcoin and Ethereum, investors can consider allocating some funds to another high-growth coin. Another option that we like is Battle Infinity, which is one of the best penny cryptocurrencies in the market right now. Battle Infinity is building a decentralized gaming platform in conjunction with a P2E rewards system.

This means that by playing Battle Infinity games, players can generate free crypto tokens - paid in IBAT. The first game to launch is the IBAT Premier League - which is a globally-accessible fantasy sports tournament. Players can pick a 'dream team' from their favorite sport and earn rewards by accumulating points.

Points are determined by the real-world performance of each sports player from within the selected team. This offers an experience that connects the virtual and real-world worlds into one ecosystem. Players also have the opportunity to earn the best NFTs within the Battle Infinity metaverse, which can then be traded on the IBAT marketplace.

Players can also trade their IBAT tokens for other crypto assets on the Binance Smart Chain, via the Battle Infinity DEX. More than $5 million worth of IBAT was sold in presale funding - with the hard cap being reached in just 24 days. Those looking to buy Battle Infinity tokens for maximum portfolio diversity can do so on PancakeSwap or LBank.

5. Uniswap - Invest in the Future of Decentralized Finance

The best crypto portfolio allocation strategies will also look to dedicate capital to growing trends and markets. At the forefront of this is decentralized finance, which offers traditional financial services to consumers without requiring investors to go through a third-party intermediary. Uniswap is a leader in this space, with the project focusing on Ethereum-based tokens.

On Uniswap, investors can swap one ERC-20 token for another without needing to create an account or provide any sensitive KYC documents. Instead, investors simply need to connect an Ethereum-compatible wallet to the Uniswap ecosystem and swap the two tokens in real time. Uniswap is able to facilitate this via an automated market marker (AMM) protocol.

In the most basic of terms, this removes the need for traditional order books. Instead of requiring a seller to be present in the transaction, the AMM system at Uniswap relies on liquidity pools. Each pair will have equal amounts of both tokens, which ensures that Uniswap can offer its trading services in a decentralized manner - 24/7.

Furthermore, liquidity pools can be funded by anyone, which enables investors to generate passive income on their idle tokens. Uniswap is therefore one of the best yield farming crypto platforms for passive investors. One of the easiest ways to add UNI tokens to a portfolio is to invest via the regulated and low-cost broker - eToro.

Cryptoassets are highly volatile and unregulated. No consumer protection. Tax on profits may apply.

Building a Diversified Crypto Portfolio - Balancing Methods

There is no one-size-fits-all strategy that can be taken when evaluating the best crypto portfolio allocation. The reason for this is that each investor will have their own financial goals and risk appetite.

Nonetheless, there are a number of core strategies that can be undertaken when building a balanced crypto portfolio, which we discuss in more detail in the sections below.

Portfolio Weighting

A great starting point is to assess the weighting of the crypto portfolio. The 'weighting' simply refers to the percentage breakdown of each crypto investment type. A well-balanced portfolio should be heavily weighted to large-cap and established projects.

- While the specific weighting will ultimately be determined by the investor, risk-averse traders might consider allocating 70% of their crypto portfolio to Bitcoin and Ethereum.

- The argument here is that both projects have solidified their status in this space, and subsequently, represent two of the best long-term crypto assets.

- In this scenario, this would leave 30% of the portfolio on small and medium-cap projects.

Although risker when compared to Bitcoin and Ethereum, smaller-cap projects that have recently entered the crypto space can provide above-average gains. As we noted earlier, for example, Tamadoge tokens have grown by more than 315% in just one week of trading.

In comparison, Bitcoin has increased by 1.40% during the same timeframe, while Ethereum has declined by 1.24%.

In theory, this would mean that while 70% of the portfolio has remained stagnant over the prior week, if 30% was allocated to high-growth projects like Tamadoge - the investor would still be looking at sizeable gains.

Diversification of Each Niche Market

Each crypto project in the market will look to target a specific niche - such as the metaverse, NFT gaming, smart contracts, or interbank payments.

The fact is, however, that within each niche, there are many crypto assets competing for their share of the respective market.

Let's take smart contracts as a prime example:

- We mentioned earlier that Ethereum dominates this space considerably - with thousands of ERC-20 tokens built on its network.

- However, there are many other smart contract blockchains in the market - some of which offer faster, cheaper, and more scalable transactions.

- Therefore, one of the best crypto portfolio allocation strategies in this regard would be to diversify the investment funds across multiple smart contract projects.

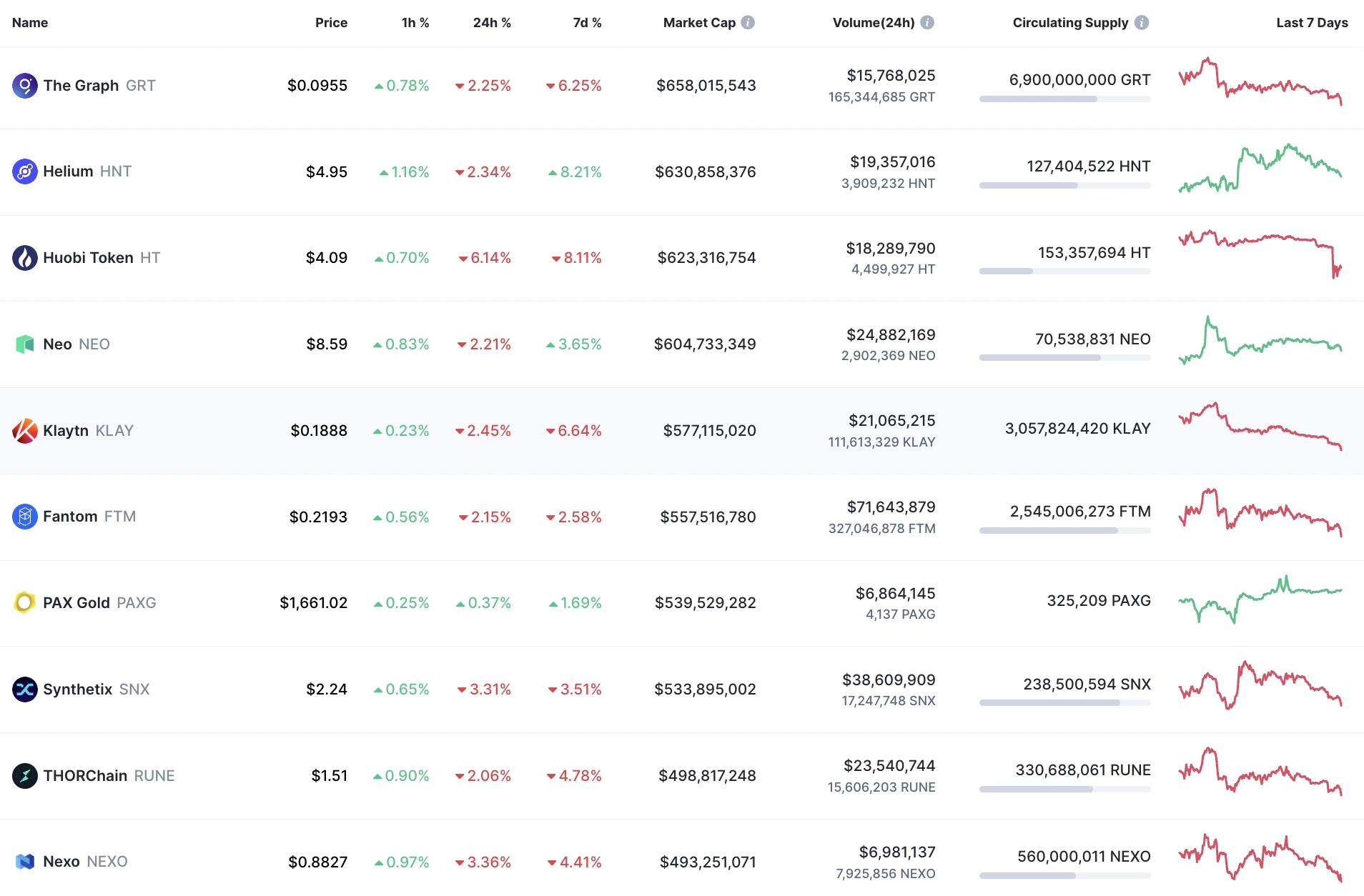

- While Ethereum might be heavily weighted, the portfolio could also allocate capital to the likes of Solana, Cardano, and Neo.

This strategy can also be deployed when investing in higher-growth projects. For instance, in addition to Tamadoge and Battle Infinity, investors might allocate funds to a selection of other crypto presales.

Consider Other Asset Classes When Gaining Exposure to Crypto

There is often a misconception that the only way to gain exposure to cryptocurrencies is to buy individual coins. While this is often viewed as the most effective way of investing in crypto, other options exist. And crucially, this offers an additional way to create a well-balanced and diversified portfolio.

Let's take Coinbase as a prime example. This large crypto exchange is a publicly traded stock on the NASDAQ. As Coinbase is a pure-play crypto stock, this means that its value is closely associated with the broader market. More importantly, from an investment perspective, Coinbase offers exposure to the wider industry without needing to pick and choose suitable crypto projects.

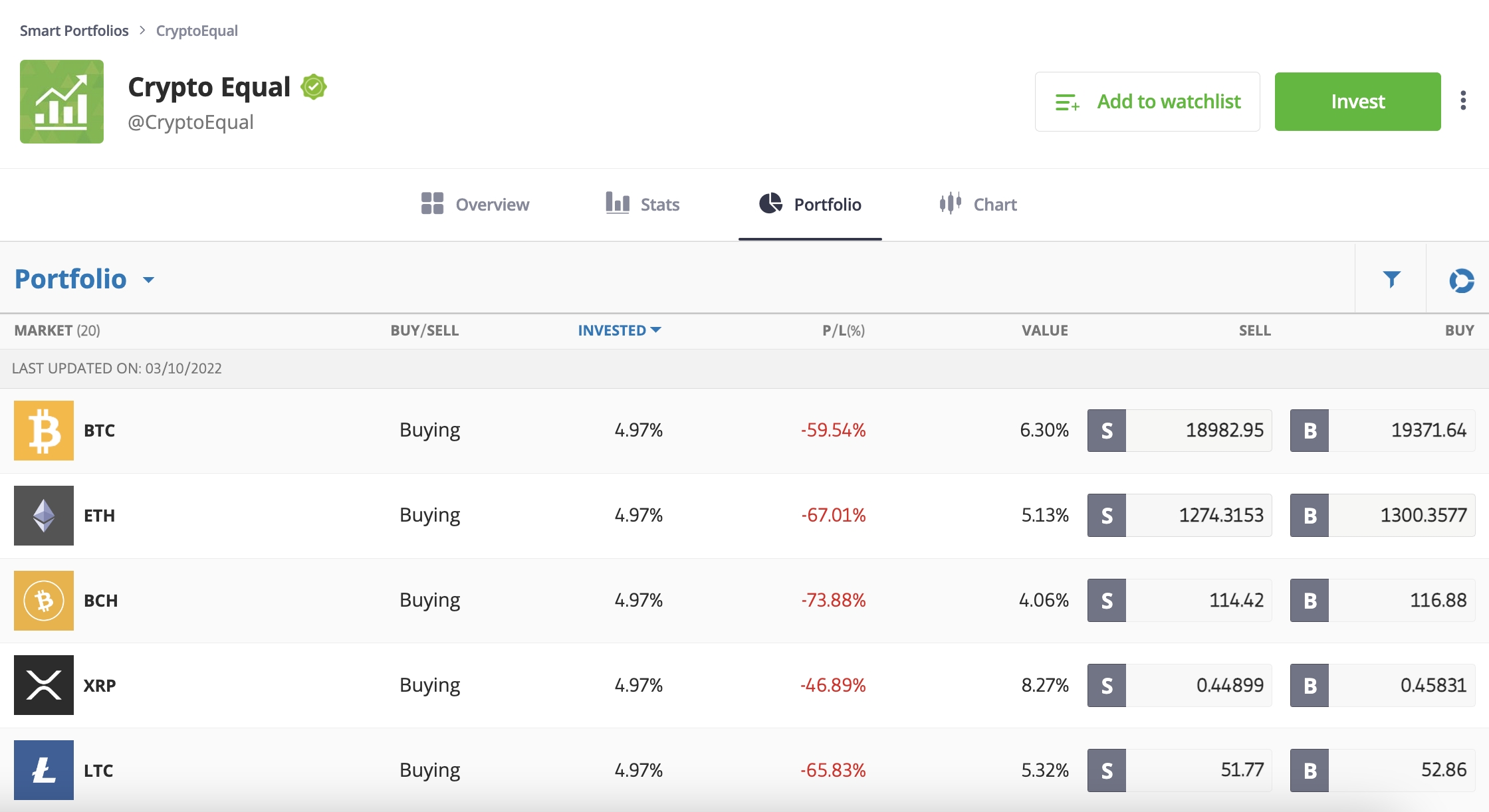

Another option to consider in this regard is an eToro Smart Portfolio. There are several to choose from and each Smart Portfolio is professionally managed by eToro. The 'CryptoEqual' Smart Portfolio, for instance, offers diversified access to 20 cryptocurrencies at equal weights of just under 5%.

This means that eToro will regularly rebalance the portfolio on behalf of its investors to ensure that it continues to align with the broader crypto market. Furthermore, not only is the minimum investment a reasonable $500, but the eToro crypto portfolio management service does not attract any additional fees.

Avoid Being Overexposed to Crypto

Additionally, it is also important to remember that to truly become a risk-averse investor, portfolios should never be 100% exposed to crypto.

On the contrary, it is wise to consider investing in other asset classes entirely, such as stocks, ETFs, or precious metals.

In doing so, when the broader crypto market is bearish - like it is right now, other assets within the portfolio might counter these losses.

For example, oil stocks and index funds have generated phenomenal results in 2022 due to ever-rising energy prices.

Why it’s Important to Have a Well-Balanced CryptoPortfolio

It can be tempting to go 'all-in' on a crypto asset that offers an attractive upside potential. However, investors should remember that this marketplace is hugely speculative. Many, if not most, cryptocurrencies in this space do not offer any long-term utility.

Instead, investors will buy tokens simply with the view of making short-term gains. While this strategy can work for some investors, most will end up burning through their capital in the long run.

For example, many top-trending crypto assets have since dropped more than 90% from the all-time highs that were achieved during the most recent bull market. Whether or not these crypto assets will recover in the future remains to be seen.

This once again highlights the importance of creating a well-balanced and diversified portfolio. With that said, investing in low-cap projects and crypto presales can still represent a viable investment strategy.

It's just that investors should think carefully about how much of their portfolio to allocate to each project and exactly how much to invest in each crypto. Another factor to bear in mind is that there are now more than 21,000 cryptocurrencies listed on CoinMarketCap.

There is only so much liquidity to go around, meaning that not all projects will witness notable growth - if at all. But, by investing in a large number of projects with a sensible amount of capital, this offers the best crypto portfolio allocation strategy in the long run.

How to Diversify Your Cryptocurrency Portfolio

Creating a diversified and well-balanced cryptocurrency portfolio can be a daunting task for beginners.

In this section, we offer a step-by-step overview of how to proceed.

Step 1: Assess Investment Capital

The first step for investors to take is to evaluate how much capital they can allocate to their crypto portfolio.

This should be an amount that the investor is comfortable losing, owing to the speculative and volatile nature of crypto assets.

Step 2: Create DCA Strategy

Once the size of the investment capital has been assessed, the next step is to create a dollar-cost averaging (DCA) strategy. This means that instead of investing the entire capital in one lump sum, the investor will split each crypto asset purchase over an extended period of time.

- For example, let's say that the investor has $5,000 that they wish to allocate to their portfolio

- An example of a sensible DCA strategy would be to split the $5,000 capital over 10 monthly investments of $500

This means that the investor will average out the cost price of each crypto asset that they buy.

Step 3: Determine Portfolio Weight

Before assessing the best crypto to buy, investors should first evaluate their portfolio weighting. This should be determined by the financial goals and risk appetite of the investor.

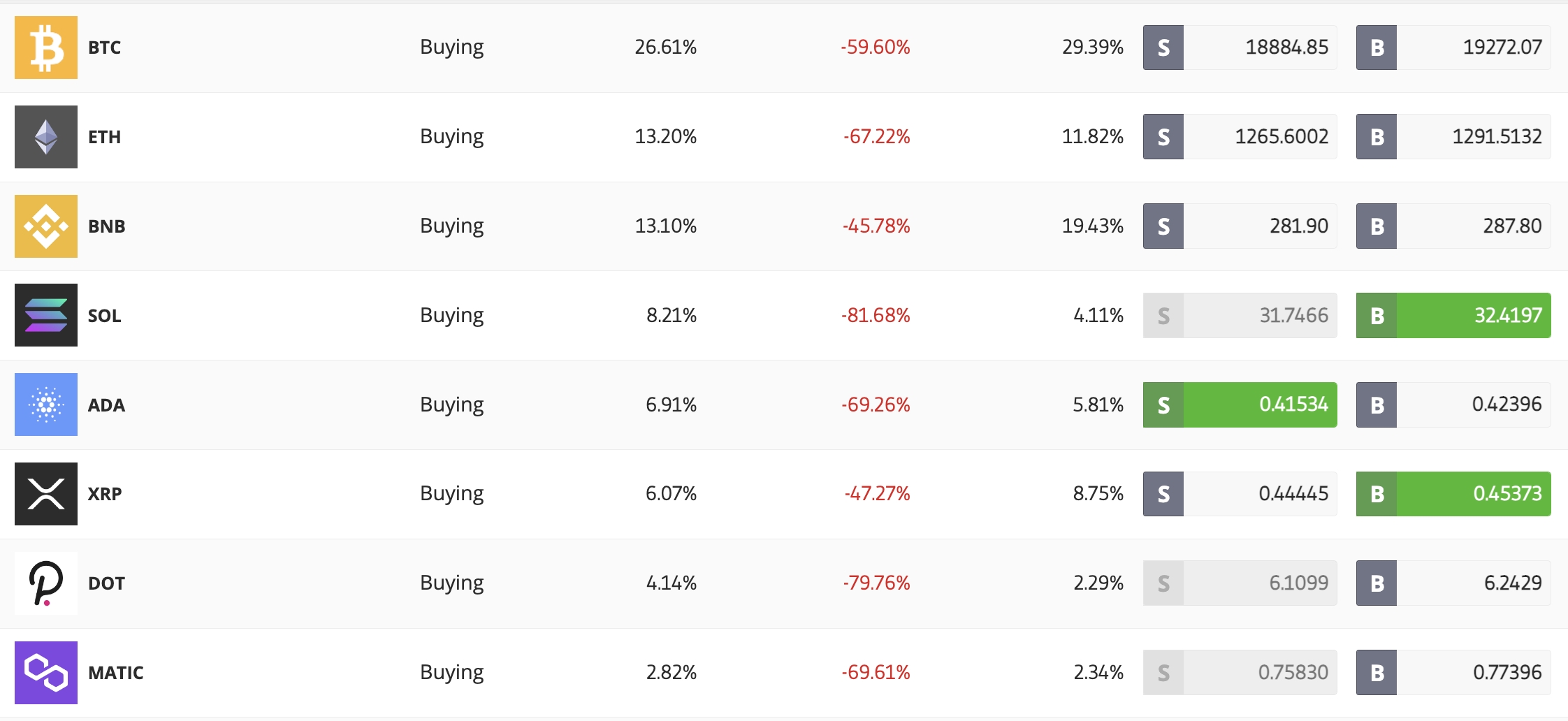

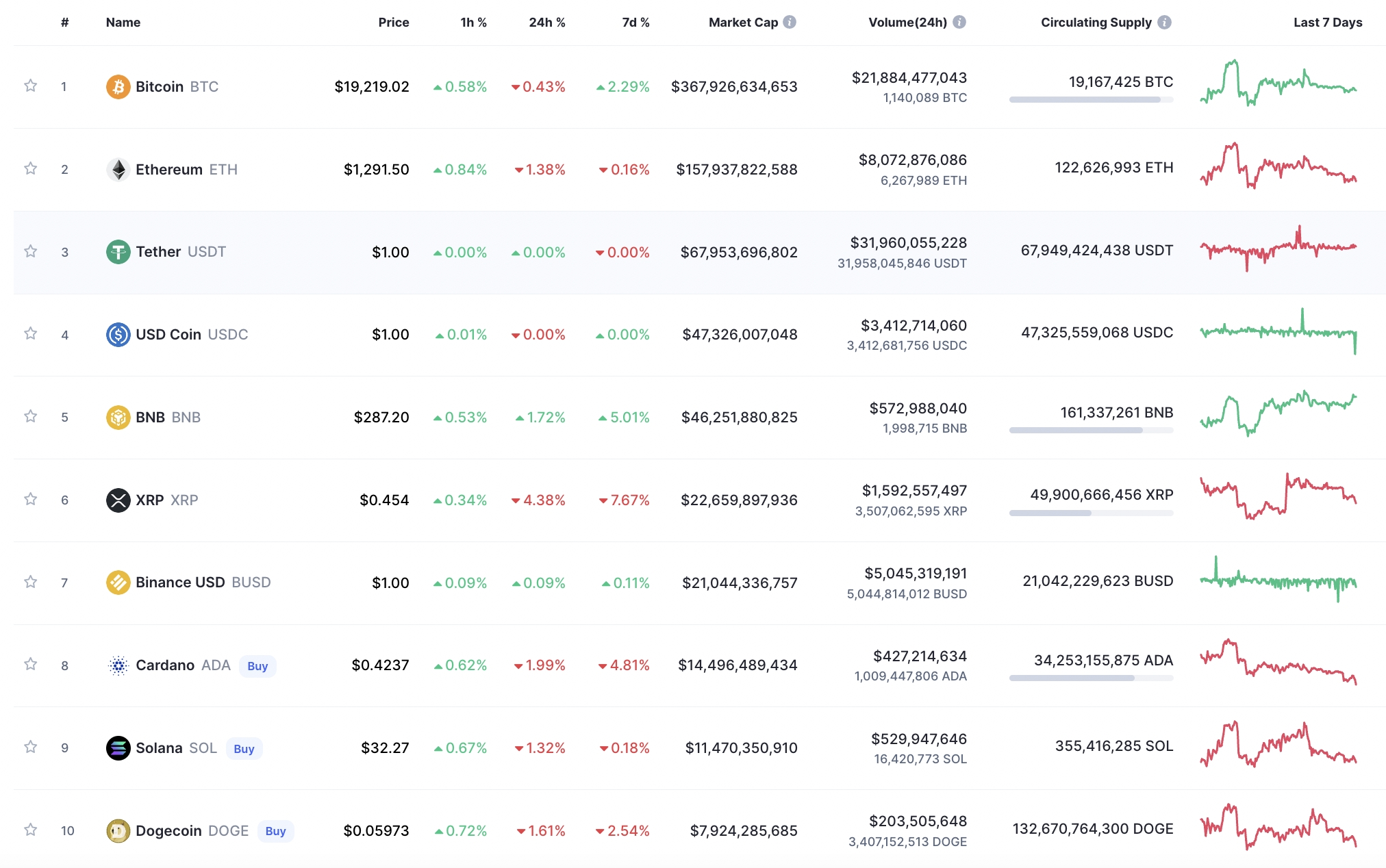

To offer some insight, investors might consider allocating 70% of the portfolio to large-cap cryptocurrencies. Excluding stablecoins - as of writing, there are just six crypto projects that meet this criterion, inclusive of Bitcoin, Ethereum, BNB, XRP, Cardano, and Solana.

The investor might then consider allocating 20% to medium-cap projects that have a valuation of between $2 billion and $10 billion. As of writing, there are approximately 20 projects that meet this criterion.

The final 10% of the portfolio could go to small-cap projects, which cover more than 99% of the 21,000+ tokens listed on CoinMarketCap. Within this segment of the portfolio, investors might consider adding dozens or even hundreds of small-cap tokens, for ultimate diversification.

Step 4: Begin Investing

Once the make-up of the portfolio has been identified, the investor can then begin allocating funds to each crypto asset. In this regard, it is important to choose an exchange that offers access to a large number of cryptocurrencies alongside competitive fees.

OKX is a great option, not least because the exchange offers more than 600+markets across large, medium, and small-cap cryptocurrencies. This even includes the newly launched Tamadoge, which we discussed extensively earlier.

Just remember, that each purchase should be in line with the dollar-cost averaging strategy discussed in Step 2. For example, if 10% of the portfolio was allocated to small-cap cryptocurrencies and the monthly DCA investment is $500, just $50 should go to projects within this category.

Examples of Well Balanced Crypto Portfolio Allocations

To reiterate, there is no one-size-fits-all strategy when creating a well-diversified and balanced crypto portfolio. On the contrary, the make-up of the portfolio will differ from one investor to the next, based on their risk profile and long-term goals.

Nonetheless, to offer some insight into what a medium-risk crypto portfolio might look like with an investment capital of $10,000, consider the following example:

50% - Large-Caps

A medium-risk crypto investor might elect to allocate just 50% of their portfolio to large-cap coins. As noted above, just six crypto assets carry a large market capitalization, excluding stablecoins.

The investor might elect to hold 50% of their large-cap crypto investments in Bitcoin, with the balance spread out across the remaining five tokens.

So, the total investment is $10,000 and 50% is allocated to large-cap projects - so this segment of the portfolio would look like the following:

- Bitcoin - $2,500

- Ethereum - $500

- BNB - $500

- Cardano - $500

- XRP - $500

- Solana - $500

30% - Medium-Caps

Of the $10,000 capital, the investor elects to allocate 30% to medium-cap projects - or $3,000.

The investor might elect to buy a wide range of crypto assets from various markets and niches. In this example, we'll say the investor opts for five different mid-caps at $600 each.

- Dogecoin - $600

- Polkadot - $600

- Polygon - $600

- TRON - $600

- Shiba Inu - $600

20% - Small-Caps

The remaining 20% - or $2,000 of the portfolio will be allocated to small-cap projects.

In this example, the investor opts for eight small-caps at $250 each.

An example of this might look like the following:

- Tamadoge - $250

- Battle Infinity - $250

- DeFi Coin - $250

- Lucky Block - $250

- Compound - $250

- Waves - $250

- Nexo - $250

- The Graph - $250

Portfolio Recap

To recap, from a $10,000 capital investment, the portfolio has opted for six large-caps ($5,000), five medium-caps ($3,000), and eight small-caps ($2,000).

As a result, the portfolio owns 20 different crypto assets from a range of different markets. This is, however, just a simplified example of cryptocurrency portfolio allocation.

Investors should determine their own portfolio weighting and chosen projects, as per their own financial goals and risk profile.

Conclusion

To ensure that investors enter and remain in the cryptocurrency arena in a risk-averse manner, portfolio diversification should be considered. A well-balanced portfolio will contain a good blend of large-cap projects, inclusive of Bitcoin, Ethereum, and BNB.

Exposure to newly launched and small-cap projects might be considered too for maximum upside potential. Tamadoge is a popular option here, which was recently listed on the OKX exchange after raising more than $19 million in presale funding.

FAQs

What is the best portfolio for crypto?

The best portfolios in the crypto space tend to be well-diversified. With more than 21,000 projects to choose from, diversification has never been more important. Consider allocating a large segment of the portfolio to established projects like Bitcoin and Ethereum, with the balance split out between up-and-coming tokens such as Tamadoge, Battle Infinity, and Lucky Block.

How should I diversify my crypto portfolio?

The easiest and perhaps most effective way of diversifying a portfolio is to invest in dozens of different projects. Established tokens in the portfolio might include Bitcoin, Solana, BNB, and XRP. Investors should also consider allocating funds to smaller-cap cryptocurrencies that offer a more attractive upside. All in all, the portfolio should be balanced to mitigate the risk of being overexposed to a crypto project that fails.

How many coins should I have in my crypto portfolio?

There really is no limit to the number of coins that can be held in a well-balanced and diversified portfolio. In fact, it is often the case that the more different projects that an investor has exposure to - the better. Consider using an exchange like OKX for the diversification process, which offers more than 600 markets.

What percentage of a portfolio should be crypto?

This really depends on the risk appetite and individual profile of the investor. Risk-averse investors will typically limit their exposure to crypto - with just 5-10% of their portfolio allocated to the space. At the other end of the spectrum, some investors choose to be 100% in crypto. This is, however, a high-risk strategy, especially considering that the broader crypto market tends to move in tandem.