First Bitcoin ETF Moves to November Contracts as Competition Heats Up

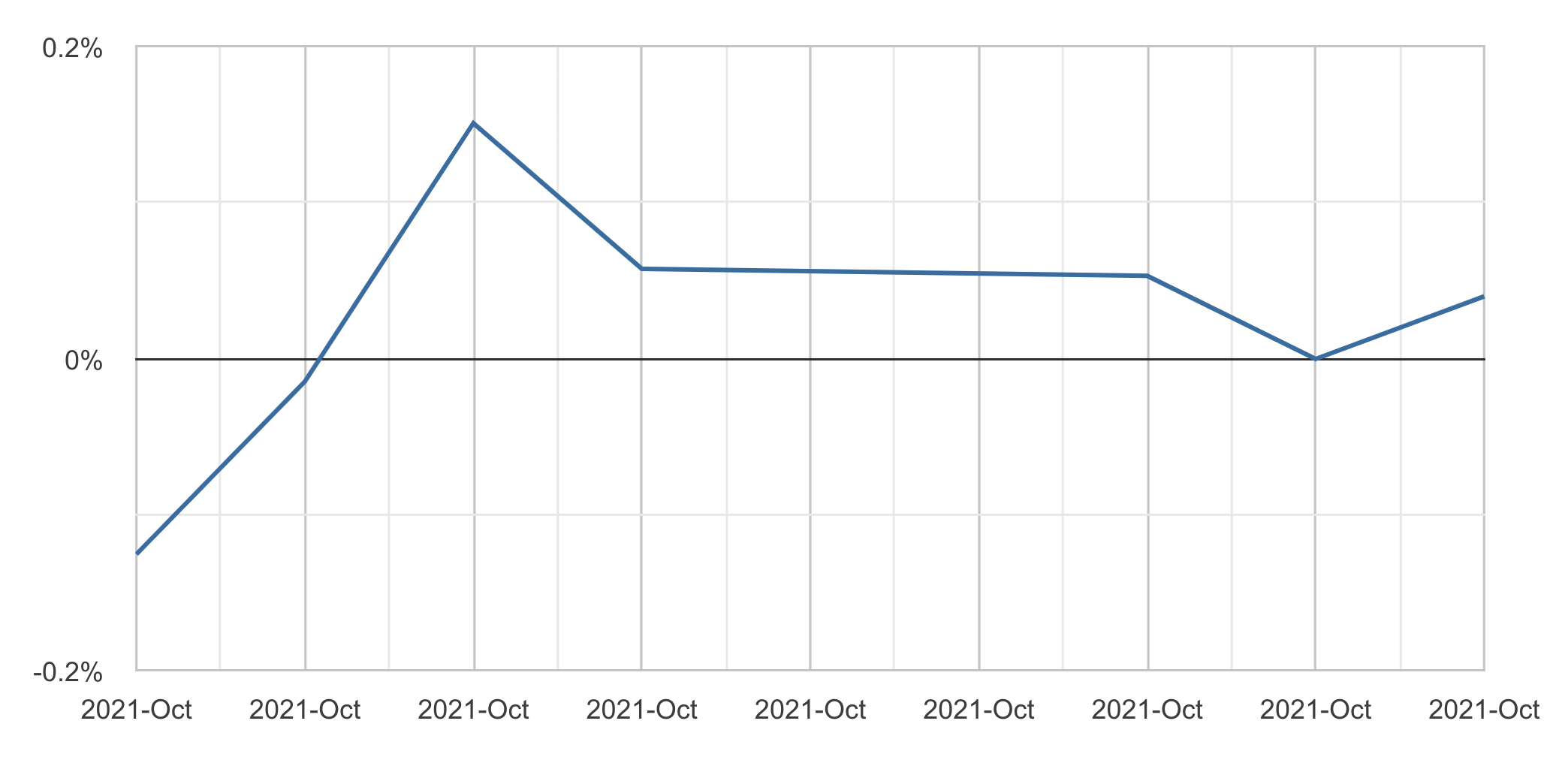

Despite initial worries that the first bitcoin (BTC) futures-backed ETF would turn out too popular for its own good, data from the ETF’s issuer, ProShares, shows that it is still trading at modest premium.

As of Thursday, the ProShares Bitcoin Strategy ETF with the ticker BITO traded at a premium over its net asset value (NAV) of just 0.04%, after having seen premiums as high as 0.15% on October 21, data from ProShares showed.

The data is interesting given previous reports of ProShares being in danger of hitting a limit set by the Chicago Mercantile Exchange (CME) on how many front-month futures contracts a single entity can hold. The current limit is still that a single ETF can hold a maximum of 2,000 front-month futures contracts, with BITO amassing nearly 1,900 contracts after just two days of trading.

And although the CME has said that it will increase the limit on how many front-month contracts can be held to 4,000 starting in November, BITO has already expanded its buying to longer-dated contracts to get around the problem.

According to data current as of Wednesday, ProShares’ ETF now holds 3,233 bitcoin futures contracts expiring in November, and only 572 October contracts, with each contract representing the value of 5 BTC.

As is well-known among futures traders, however, the price of a futures contract typically rises the further away its expiration date is, a situation known as contango. As such, having to buy longer-dated contracts will normally cause tracking errors in the price of the ETF relative to the spot price of bitcoin.

Meanwhile, the competing bitcoin ETF launched by Valkyrie with ticker BTF remains smaller than BITO, which also means that it is able to keep a larger share of its total holdings as front-month contracts.

This fact was also pointed out by Valkyrie’s Chief Investment Officer (CIO) Steven McClurg on CNBC on Monday, where he said that the size of their ETF means they can “stick with the front months and we show that we're tracking the futures really closely.”

“It's a concern for ProShares and that’s why they applied for this extension to be able to have access to more futures contracts,” McClurg said. “If that doesn't happen, we've seen some signals from the folks at ProShares that they’re going to look at other derivatives like swaps or structured notes able to fill the demand,” he continued.

And according to data from Valkyrie, it appears the firm’s CIO is right that their ETF is tracking at least the futures market very closely.

As of Wednesday, the ETF held an equal amount of 85 futures contracts expiring in October and 85 November contracts, in addition to 9 “Micro Bitcoin” contracts expiring in October. According to the same data, BTF traded at a price equal to its NAV as of Wednesday this week.

And while BITO is still enjoying its massive first-mover advantage, more and more ETFs are joining the group of bitcoin-related ETFs.

Just today, the market already saw the launch of a bitcoin-related ETF, with Volt Equity’s ‘Crypto Industry Revolution and Tech ETF’ going live on the New York Stock Exchange (NYSE) under the ticker BTCR.

Unlike the other ETFs listed recently, however, Volt Equity’s ETF does not track bitcoin directly, but instead holds shares of companies that in various ways are involved in the Bitcoin economy, including miners, hardware manufacturers, and major BTC-holding companies like MicroStrategy.

The new ETF gained over 1.6% in its first 20 minutes of trading.

Meanwhile, a new ETF from the well-known issuer VanEck is stepping the game up further with its plans to undercut both Valkyrie and ProShares on fees.

According to a filing with the US Securities and Exchange Commission, VanEck’s ETF, with the ticker XBTF, will charge a fee of just 0.65%, significantly undercutting the existing players.

The move by VanEck led the Financial Times to estimate that we could see “a potentially ‘brutal’ price war for US-listed bitcoin exchange traded funds could kick off as soon as Monday,” a development that in all likelihood would be most welcome among retail investors.

____

Learn more:

- ‘Exiting Times’ as Australian Managers Ready ‘Inevitable’ Bitcoin ETF Offerings

- Here's What You Need to Know About the Bitcoin Futures ETF

- Following the First Bitcoin ETF, Ethereum Might be Next