What Is Bitcoin Cold Storage?

What is cold storage for Bitcoin is one of the most often asked questions due to the rising popularity and people’s need to keep their coins secure. The storage (or a wallet) safeguards the secret code you need to use your bitcoins and helps...

“What is Bitcoin cold storage” is one of the most frequently asked questions. Due to the rising popularity of Bitcoin and cryptocurrencies, a growing number of people are seeking to keep their coins secure, and Bitcoin cold storage is one of the most secure solutions.

What is Bitcoin cold storage?

When you picture a Bitcoin cold storage, you may see a modern, cutting-edge fridge hidden somewhere in a top-secret bunker. However, Bitcoin cold wallets, much to the disappointment of some, are mere paper notes, things or devices that are kept offline. They take the form of hardware wallets, paper wallets, USB sticks, encrypted data storage devices, and even physical bearer items. The fundamental rule for a wallet to classify as a Bitcoin cold storage is the capability to store Bitcoin private keys and keep it offline so that one can steal it over the internet.

Cold hardware wallet by Trezor.

Cold hardware wallet by Trezor.

The storage (or a wallet) safeguards the secret code you need to use your Bitcoins and helps manage transactions, something like a private internet banking account. The code, which serves as a password, is called a “private key” and is vital to the security of your money. Anyone who gets your private key can steal your Bitcoins. And if you lose your key, your Bitcoins are gone, too. So it’s important to protect private keys against accidental loss and back them up.

So, Bitcoin cold storage refers to keeping a reserve of Bitcoins offline. It is often a necessary security precaution, especially if you deal with large amounts of Bitcoin. It is considered the safest way to protect your digital assets.

When you should use a cold wallet

Consider an offline (aka “cold”) wallet for storage if:

— You need to store a large amount of Bitcoin and security is a top priority;

— You don’t need to use it often or access it anytime, anywhere;

— You prefer to safeguard your funds yourself rather than trust a third party;

— You’re ready to pay for hardware (typically from about 50 to a couple hundred dollars);

— Privacy is important to you.

Storing Bitcoin offline in cold storage gives you plenty of flexibility. You can use a USB drive or other offline data storage medium stored in a safe place, a paper wallet, a bearer item, like a physical “Bitcoin” coin, or purchase a dedicated offline hardware wallet.

How to set up Bitcoin cold storage largely depends on the storage method. If you want to use paper, check out our guide on making a paper wallet.

If you consider buying an actual hardware wallet, such as Ledger or Trezor, simply follow the instructions that come with it.

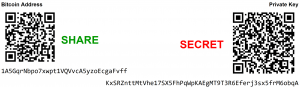

An example of Bitcoin paper wallet.

An example of Bitcoin paper wallet.

Hot and cold Bitcoin wallets

Online, or so-called “hot” Bitcoin wallets are less secure due to the threat of hacking. Web wallets are especially vulnerable as most of them require you to reveal your private key to a third party or introduce a counterparty risk.

Despite that, most cryptocurrency holders use both cold and hot wallets. Hot wallets are more suitable for frequent trading and everyday spending, while cold wallets are better for long-term holding of your crypto assets.

Thus, a standard recommendation is to utilize both types of wallets. Have at least one hot wallet with a small amount of Bitcoin for daily transactions, and one or several cold wallets for securing large sums. You can have as many wallets as you like, so if you are proficient in handling private keys, the more wallets, the better.

Risks of Bitcoin cold storage

If you decide to go for a cold wallet, be wary of the following risks.

- If you choose to use a hardware wallet, be sure to back up and safely store its seed/recovery words.

- Unlike the hardware wallets, USB’s can become compromised and hacked.

- Hardware devices can be broken or damaged.

- If you go for using a paper wallet, be aware that anyone who sees it can copy your write keys and steal it.

- An error in transcription can cause loss of funds.

- Paper can rot, be torn, or burn.

- All devices can crash, making data recovery quite expensive.

All in all, cold storage is a highly secure option to keep your digital assets. Yet, be aware that if it is implemented recklessly, even the safest cold storage cannot protect you against theft. Remember to keep information about your Bitcoin savings private, always backup your private keys, and stay safe.

And here you can find more information on how to evaluate a specific wallet.

For more information on how to keep your coins safe, read our guide.