How To Buy Cardano (ADA)?

Becoming a cryptocurrency fan favorite, Cardano (ADA) has risen to become one of the top blockchain projects around. Their goal to...

Becoming a cryptocurrency fan favorite, Cardano (ADA) has risen to become one of the top blockchain projects around. Their goal to advance the frontiers of crypto has spoken to a large fanbase. Like Ethereum, it is used in the creation of decentralized applications (dapps) and digital assets.

What makes Cardano so alluring is that each phase of the project has been peer-reviewed by researchers in order to bring about the best possible project according to its developers. The magnitude of the peer-reviewed research is impressive, so there is no doubt that each step of the Cardano road map has been carefully thought out.

Charles Hoskinson, one Co-Founder of Ethereum, leads the project. He had to part ways with Ethereum over a dispute whether the project should be nonprofit, which was Vitalik Buterin’s view, or commercial, which was Hoskinsons view, founding Cardano from this rift. Hoskinson is always at the forefront of the crypto community with his continuous streams of content and marketing. This has gained him a passionate fanbase of cryptocurrency advocates.

The blockchain project has proven to be a hundred times faster than the current Ethereum network, which hasn’t fixed the transaction speed issue of older blockchain networks. Cardano’s gas fees also won’t break the bank since the network isn’t as clogged up as of right now. One of the aims of Cardano is to spread decentralized protocols to poor countries that otherwise wouldn’t have access to them. The results of these ventures, in turn, may thrust this project far into the future and may find it a rival to Ethereum for years to come.

Indeed, 2021 has looked to be a good year for Cardano. With projects springing up, a roadmap that is nearing complete realization and continuously being one of the top projects in terms of market cap, Cardano should be on anyone’s eye for investment opportunities and blockchain potential.

Daedalus Wallet and other Wallet options

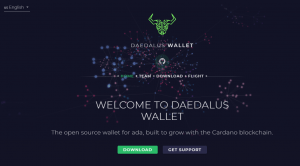

Before reviewing how to buy Cardano and which exchanges to buy Cardano on, you should be aware of Cardano's own Daedalus Wallet to store your cryptocurrency. Depending on which pool you choose to stake in, you can receive up to 6% APY when staking your Cardano on a wallet, which could be ten times the amount that of a regular savings account at a traditional bank.

All you need to do is download the Daedalus Wallet, wait for your wallet to sync up with the network and choose staking pools. With this method, you’re also running a full node on the Cardano network. Staking pools in that network means you’re an active participant in the decisions that are happening in Cardano, instead of just leaving it on an exchange for purely trading purposes. One thing to note is that staking could fluctuate in the market in real time. For example, you may see your stake at 8% and then watch it drop to 4%.

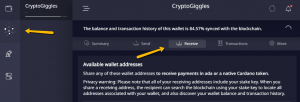

Once you buy it on an exchange, you just have to go to the wallet section and find your receive address to input into the exchange when withdrawing your cryptocurrency. Also, the geometric pattern, perhaps representing a chain of blocks, a ‘blockchain’ if you will, is where you’ll find your staking options.

Of course, putting some Cardano in a hardware wallet like Ledger or Trezor would help in diversifying the security risks of your asset, instead of just leaving it on an exchange or staking it on the Daedalus wallet. This will ensure that you are your own personal bank and are more in charge of your destiny, like the legacy ways of cryptocurrency storage. A hardware wallet is bare in functionality so that it is far less susceptible to hacks, making it a great place to store your crypto.

Although not recommended, you could just leave all your coins on an exchange. Exchanges are nowadays being audited and come with baseline security protocols, so they aren’t the worst place to leave your crypto once you buy. But if you’re looking to have a bigger impact in the direction of the Cardano network or want to use actual Cardano applications to store your cryptocurrency, or even just want a higher APY than what your exchange offers, you should check out the Cardano’s own Daedalus wallet.

How to Buy Cardano (ADA) on Exchanges

There are some exchanges out there that you will need to know how to do regular spot trading on a tradingview graph. If your exchange gives a way to buy ADA through your native currency, you usually have to go through some Know-Your-Customer (KYC) hoops, like giving your centralized bank details and identification.

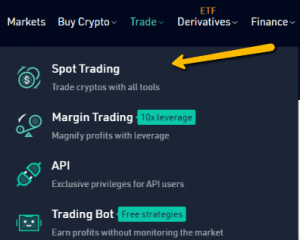

Spot trading is the easiest way to buy crypto and is how most HODLers buy crypto. You are buying crypto at the price that the exchange gives you, which is usually based on a price that the exchange had for the crypto on the day you are buying. For many exchanges, spot trading is the simple ‘buy’ option.

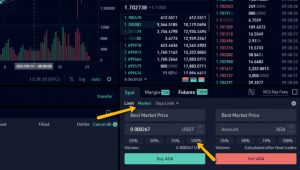

If spot trading isn’t a simple buy option, you should learn a way to spot trade on the tradingview graph. Whichever exchange you sign up for, go to the trade section and pull up the graph. In the example exchange above, this is under Trade > Spot Trading.

In the example above, the trading pair is USDT / ADA. There is usually a dropdown you can find your trading pair and a search bar near it. If your chosen exchange can’t directly trade for ADA through fiat, you may have to first trade for another cryptocurrency.

You merely have to deposit how much of your fiat or crypto into your trading account, click on the amount of that coin you have that you want to trade (whether that’s 25%, 50%, 75%, or 100% of the crypto you own) and then click Buy ADA. Alternatively you can also type in the amount that you want to trade and that will be converted into ADA.

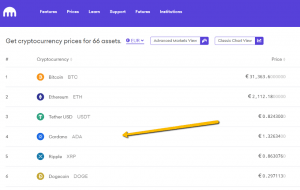

tOP Cryptocurrency Exchanges to Buy Cardano (ADA)

These exchanges have been chosen with an objective metric in mind, as in the market value that circulates through them. This means that users buy and trade Cardano there frequently with users trusting them to circulate their Cardano. Along with this, these exchanges are the ones that have been reviewed on our website. Exchanges with ADA staking options are mentioned, too.

1. Binance

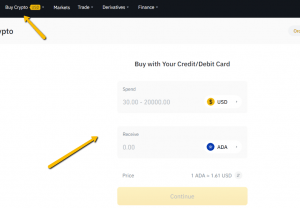

Binance is the biggest exchange out there and one that cryptocurrency users think about when they think about exchanges. The ADA / USDT pair, in particular, circulates at a high rate and it’s quite simple to trade anything from USD to euros when it comes to fiat to ADA trading. Their fees are low and they have lots of tutorials to help a user getting started with trading. Binance has a very recognizable design color scheme, the gold and black, and the interface is user-friendly, with tutorials for beginners and advanced options for traders who become more experienced. You are also able to buy ADA with certain fiat currencies through the simple Buy Crypto button.

You can find a full review of Binance here.

2. Coinbase

Although it doesn’t have the lowest fees, Coinbase made news when it listed Cardano on the exchange. It’s also one of the easiest ways to trade USD for ADA as they have the direct pair listed. If you’re savvy enough, you can go to Coinbase PRO and trade for ADA with lower fees. There is a 24/7 customer support service, the ability to use a Coinbase card, as well as a beginner-friendly interface. Coinbase has been a stop for traders just getting acquainted with crypto.

You can find the full review here.

3. Kraken

Although Kraken doesn’t have the highest Cardano volume, it’s worth mentioning because of its reputation as an exchange with high security as well as being able to stake Cardano on it for high APY. With its regular security audits, personal security measures, and self-regulation, Kraken has built a name for itself with security. Although it’s not recommended to leave all of your assets on an exchange, if you must, you can’t go wrong with Kraken. This is important since if an exchange is offering staking opportunities like this, security becomes of prime importance for that option. And Kraken has that in spades.

You can find the full review here.

4. KuCoin

Although KuCoin doesn’t provide a direct fiat currency to trade for ADA, it has one of the highest volumes. KuCoin also has a simple onboarding system that doesn’t need you to provide a bunch of Know-Your-Customer trading to begin trading crypto-to-crypto. If you want to buy fiat using Kucoin, however, you need to provide information. But the fact that this isn’t forced onto you is a very big plus. This means that those New Yorkers or other highly regulated places can trade for ADA with KuCoin. They also have multiple wallets provided for you that you can just transfer crypto to and start trading. The only thing is that it doesn’t provide a fiat-to-ADA direct pair, but the user interface is friendly enough that figuring out how to buy ADA through it with stablecoins like USDT and USDC shouldn’t be a problem.

You can find the full review here.

5. OKEx

Like KuCoin, OKEx doesn’t have a direct fiat-to-ADA pair, but the trading volume for it is high with USDT. OKEx is an exchange that has a vast array of financial tools. So if you ever believe that your ADA is meant more than a static placement in your exchange, OKEx is a great exchange to try out. The interface is simple and neat, making it a professional way for you to use your crypto. They also have some of the highest amount of trading pairs in the industry, over a whopping 400, making it a great tool to use if you ever have the urge to exchange for something other than Cardano.

You can find the full review here.

Closing Thoughts

Cardano is quickly becoming a household name in the cryptocurrency community. With its highly researched protocols, it is perhaps a good cryptocurrency to look into.Of course, full disclaimer, you should always take necessary precautions when diving into any cryptocurrency.

Although Cardano’s future looks bright, it might be good to exercise caution and not just dump all your savings onto it. As 2021 has had Cardano reach all-time highs, and as much of the Cardano project is becoming completed, it definitely should be a crypto that is on your radar.