Will Bitcoin Ever Be Stable?

Although Bitcoin has a $60 billion market cap at the moment, it is still nothing when compared with huge global currency markets. Until the BTC market cap starts to grow into the trillions, it is highly unlikely that it will be stable enough to...

Why Does the Price of Bitcoin Fluctuate?

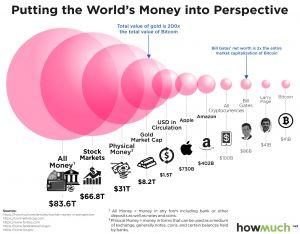

Although Bitcoin has a $60 billion market cap at the moment, it is still nothing when compared with huge global currency markets. Until the BTC market cap starts to grow into the trillions, it is highly unlikely that it will be stable enough to function as a currency. The volatility merely occurs because there is not enough liquidity.

Think about it. How many ways can you exchange your fiat currency into other currencies, commodities, or goods? Since almost everyone deals in fiat, you can always liquidate your cash without affecting its price. Meanwhile, despite continuous growth, very few people, merchants, or services are willing to accept Bitcoin. In fact, most central banks and regulators are actively trying to make it more difficult to buy or sell Bitcoin. It all leads to a lesser market cap and lower liquidity for Bitcoin than fiat currencies.

All of it is easier to grasp with a metaphor. Imagine a fat man jumping into a small swimming pool. As he drops, he makes a huge splash and drenches everyone around him. A lot of water is displaced from the pool, as the level of water changes. Now imagine the same fat guy jumping into a vast body of water such as a lake or a sea. There is so much water that his presence in there is so insignificant, that no matter how hard he tries, it's barely impossible to change the water level.

In this analogy, the fat guy represents an investor with a lot of money and Bitcoin is water. At this point, Bitcoin is still a tiny swimming pool and is far from being a lake. Whenever someone enters or leaves the market, they create a massive ripple effect on the price. However, once Bitcoin becomes like a lake or an ocean, the price will stabilize, and you won’t be able to notice any individuals affecting the market.

The Future of Bitcoin

Bitcoin has seen an increase in popularity in countries like Venezuela and Zimbabwe where traditional money systems have failed. Some analysts say it’s only a matter of time when other national financial systems begin to crumble, too. That is likely to be the biggest chance for Bitcoin and cryptocurrencies to gain mass trust, adoption, and liquidity.

If Bitcoin gains enough liquidity, there should be significantly less fluctuation in price. While Bitcoins market cap is around $60 billion, the most stable world currencies are measured in trillions. When and if Bitcoin gains the levels of adoption and liquidity which are near the level of usage of dominant government-issued currencies, it's price will become much more stable than it is today.

All currencies and assets change their perceived value on a daily basis. Looking back at the history of money, it becomes clear that all currencies, especially fiat, tend to depreciate due to inflation. In the case of Bitcoin today, price depreciation could occur due to a failure of its network, new regulations, stability issues, better alternatives or anything else that discouraged people from using it. However, unlike traditional currencies, Bitcoin is deflationary, which means that it should appreciate in value over time. Despite the apparent risks, it still has the best track record of all cryptocurrencies and thus signifies the most important financial innovation of our time.

You might also want to read - Why Do Bitcoins Have Value?