XETA Genesis Review

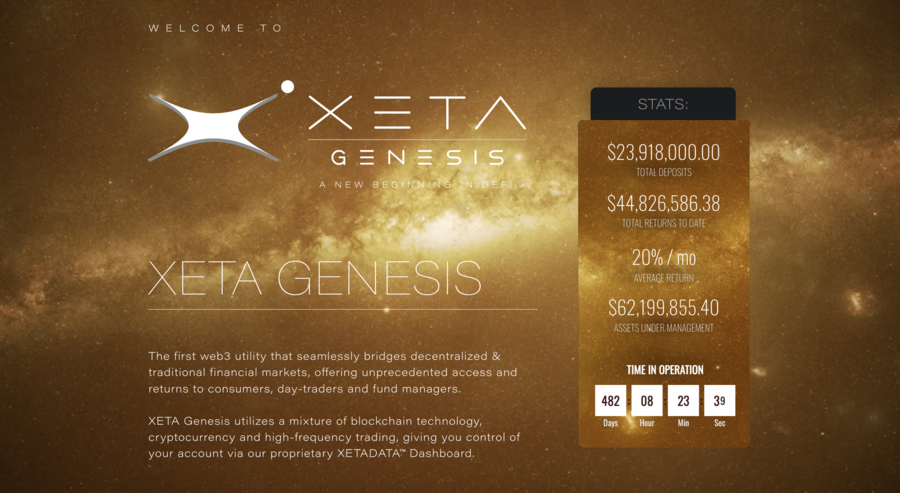

XETA Genesis aims to merge the worlds of decentralized finance (DeFi) and traditional finance (TradFi) to offer high-rewarding yet stable investment options. The platform operates in stablecoins like USDC to combat market volatility.

The platform's edge stems from its high-frequency trading algorithms. These algorithms exist across TradFi markets, including forex, gold futures, and precious metals ETFs.

On the DeFi side, investors can engage by utilizing USDC to either purchase ‘Genesis accounts’ or establish ‘Genesis pools’ through the Avalanche or Ethereum blockchains.

This comprehensive XETA Genesis review aims to give you a detailed understanding of its mechanics, risks, and potential.

XETA Genesis: An Overview

Xeta Genesis essentially bridges DeFi and TradFi systems to offer the best of both worlds. Launched in July 2022 under the original name ‘XETA Capital’ by founders Gavin Minty and @Shotime2kX, the project aims to maximize investor returns while keeping the risk relatively low.

It leverages high-frequency trading in well-established markets, such as forex and precious metals, including gold ETFs and futures.

The trading methodologies center around technical indicators like moving averages, momentum oscillators, and support and resistance levels. These strategies aim for incremental, consistent profits, particularly in the forex arena.

With a track record exceeding a year, the project has shown its viability by delivering as much as 20% monthly returns to its stakeholders.

While the project has evolved through several phases, including a phase involving its XETA token, it has now standardized its investment and withdrawal processes.

Currently, all transactions are exclusively conducted in USDC to fight against market volatility and offer simple investment tracking for users.

Understanding the XETA Genesis Framework

To start earning passive income on XETA Genesis, the first step is setting up a digital wallet compatible with the Ethereum or Avalanche blockchains, such as MetaMask. Avalanche is often more economical due to its lesser transaction fees than Ethereum.

You can access the platform's features once your wallet is connected to XETA Genesis. There are two ways available for participation:

- Genesis Accounts (Membership-based)

- Pools

Genesis Accounts

Opting for a Genesis Account essentially means buying into a membership rather than directly investing in the project.

These accounts are tailored for individual investors and come in three pricing tiers: $250, $500, and $1,000 in USDC.

As a Genesis Account holder, you are eligible for returns up to 20% over 28 days, during which you can also opt for withdrawals.

However, the account has a lifespan of one year, after which renewal is required for continued membership.

A Genesis Account carries a $25 monthly maintenance charge and a 2.5% withdrawal fee. Additionally, you're restricted to withdrawing only your returns; the initial principal remains locked in.

Any failure to meet the monthly $25 fee results in account termination and the forfeiture of your existing funds.

Example:

- Initial Investment: Assuming you start by investing $1,000 in USDC into a Genesis Account.

- Returns: Over 28 days, you can earn up to 20% returns on your $1,000. That's up to $200.

- Withdrawals: During these 28 days, you can withdraw your returns. Say you earn $200; you can withdraw this amount, but there's a 2.5% fee. So you'll get $195 ($200 - $5).

- Monthly Fee: A $25 monthly maintenance charge applies.

- Principal Locked: Your initial $1,000 stays locked in the account. You can't withdraw it.

So, if you earn $200 in returns and decide to withdraw it, you'll pay $5 as a withdrawal fee and $25 as a monthly fee. Your net gain would be $170 ($200 - $5 - $25) for that month.

Genesis Pools

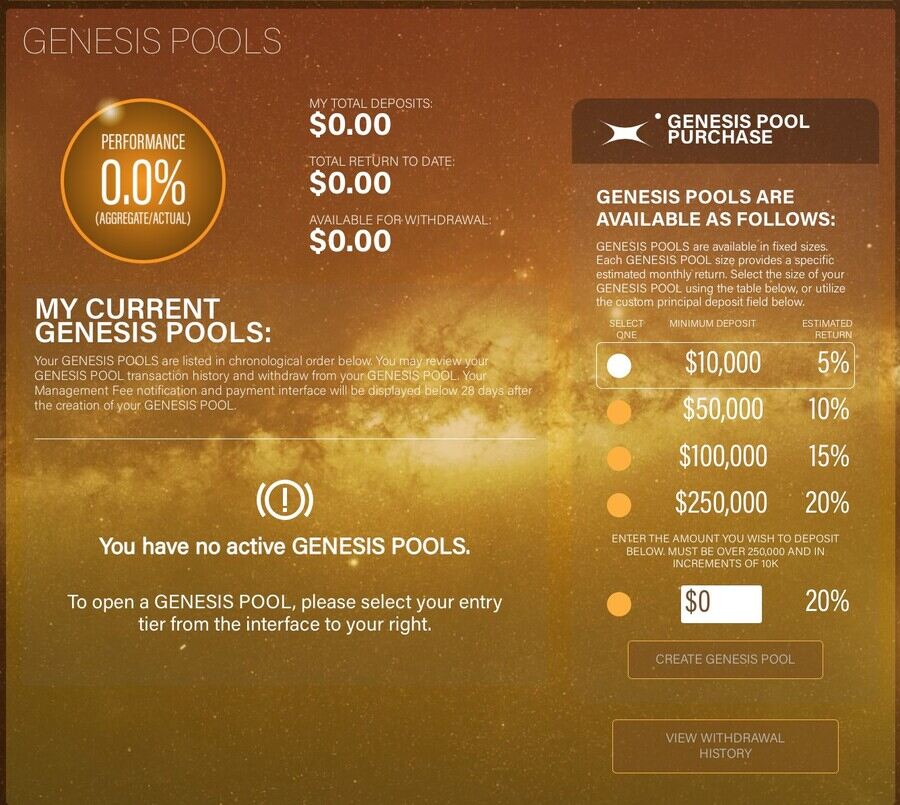

Unlike Genesis Accounts, XETA Genesis Pools are an alternative way to earn passive income under the XETA Fund (XF) umbrella.

These pools are unique in structure, governed by their own set of rules, and offer up to 20% compounding returns monthly.

Types of Pools and Returns:

- A $10,000 pool offering up to 5% monthly returns

- A $50,000 pool with a maximum of 10% monthly returns

- A $100,000 pool yielding up to 15% monthly returns

- Pools exceeding $250,000, which can earn up to 20% returns each month

Each pool has a 28-day withdrawal window with a 2.5% fee on every withdrawal transaction. Moreover, a monthly management fee of 2.5% of the pool's principal is also applicable.

Unlike Genesis Accounts, where your principal remains locked, the pools offer the flexibility to withdraw the initial investment and the returns.

Example:

- Initial Investment: You invest $10,000 into a $10,000 pool under the XF.

- Returns: This particular pool offers up to 5% monthly returns. That's $500 for the month.

- Compounding: The 5% is compounded monthly, meaning the returns get added to the principal for the next month's calculation. For example, the second month's principal becomes $10,500 if you earned $500 in the first month.

- Withdrawals: You have a 28-day window to withdraw your initial investment and returns. A 2.5% fee applies. If you withdraw the $500 return, you'll pay $12.50 as a fee, netting you $487.50.

- Monthly Fee: A 2.5% management fee applies to the pool's principal, costing you $250.

- Principal Flexibility: Unlike Genesis Accounts, you can withdraw your initial $10,000, but a 2.5% fee will apply.

So, if you earned $500 in returns and decide to withdraw it, you'd net $487.50 after the withdrawal fee. After accounting for the $250 management fee, your net gain for that month would be $237.50 ($487.50 - $250). You could also withdraw your initial $10,000, paying a 2.5% fee, but remember that doing so will take you out of the pool.

Genesis Accounts & Pools: Key Differences

While Genesis Accounts and Genesis Pools in the XETA ecosystem share some common ground, such as identical monthly and withdrawal fees, they diverge in two key areas: the ability to withdraw your principal and the treatment of unwithdrawn returns.

- Principal Withdrawal: Accounts vs. Pools - In Genesis Accounts, your initial investment stays locked in, restricting you from withdrawing the principal amount. On the other hand, Genesis Pools allows you to pull out your original investment, providing an added layer of financial flexibility.

- Treatment of Returns: To Compound or Not - Another contrasting feature is how each option deals with returns. In a Genesis Account, if you opt not to withdraw your returns within the 28-day window, those returns won't experience any compounding effects until the next cycle. Pools operate differently: if you leave your returns in, they will compound, increasing the amount you earn in the subsequent month.

Accounts | Pools | |

| Monthly Fee | $25 | 2.5% of principal |

| Monthly Return | Up to 20% | Up to 20% |

| Withdrawal Fee? | 2.5% | 2.5% |

| Can Withdraw Principal? | No | Yes |

| Monthly Compounding? | No | Yes |

Investment Mechanism

When participating in XETA Genesis, it's crucial to note that you're not directly investing in any asset. Rather, you buy a membership account or establish a pool using USDC.

XETA's team makes investments, specifically in precious metals and foreign exchange markets, leveraging high-frequency trading algorithms on your behalf.

Per XETA’s pitch deck, the company uses a unique approach to forex trading. They aim to capitalize on smaller market movements, a strategy that’s worked better in a high-leverage environment often seen in the forex market.

The XETA team claims to have a remarkably high accuracy rate of 95% for their trading signals. They also claim to offer a range of returns between 68% and 294% for their gold (XAU/USD) trading strategy over six years, with a compounded maximum return reaching over 870%.

Projected Earnings with XETA Genesis

investors can expect various return rates from XETA Genesis depending on the investment avenue they choose- Genesis Accounts or Genesis Pools.

Both promise attractive but varying rates, with Genesis Accounts offering up to 20% returns over 28 days and Genesis Pools promising up to 20% compounding returns monthly, depending on the pool size.

Such returns may seem enticing compared to conventional financial instruments but are not unheard of in DeFi. Projects like Yearn Finance have also offered high APYs but with potentially higher levels of risk. It's important to note that XETA Genesis aims to mitigate risk by diversifying into traditional markets like forex and precious metals.

The trading strategies are based on technical indicators, a common practice in crypto and traditional trading, aimed at achieving ‘incremental’ gains.

Having a track record of over a year and offering transactions exclusively in stablecoins like USDC further adds layers of security and stability.

However, as with any high-return investment, caution is advised. Smart contract failures or market volatility can impact expected returns in the crypto world.

Also, XETA's claim of up to 20% returns is a 'maximum,' which means actual returns can vary. Investors must conduct due diligence and assess if these investments align with their risk tolerance.

XETA Genesis Fee Structure

XETA Genesis offers two main investment options for investors—Genesis Accounts and Genesis Pools. Both come with their set of fees/charges.

Genesis Accounts | Genesis Pools |

| $25 Monthly Fee | 2.5% monthly (on principal balance) |

| 2.5% on withdrawals | 2.5% on withdrawals |

Manual Fee Payment: Importantly, fees are not auto-deducted from your account or returns. You must manually pay them monthly or ensure your crypto wallet has sufficient funds to cover these costs. This is crucial when investing in pools with higher amounts.

XETA's fee structure is relatively simple, but limits liquidity as your initial investment is often locked in, especially in the case of Genesis Accounts.

The fee structure aims for long-term engagement rather than quick, speculative trading, aligning with the project's goal of delivering consistent returns over time.

Minimum Investments

In the broader DeFi landscape, some yield farming pools have no minimum requirement. However, these usually involve higher risk and volatile assets.

XETA Genesis attempts to lower the risk by using stablecoins and targeting well-established markets like forex and precious metals.

The platform’s minimum investment amount is as follows;

Genesis Accounts: These membership-based accounts come in three tiers, with minimum investments of $250, $500, and $1,000 in USDC. This setup is geared toward individual investors who may not have large sums to invest but seek consistent, low-risk returns.

Genesis Pools: The pools are more suited for large investments. They start at $10,000 and go up to pools exceeding $250,000. Higher investment pools offer higher maximum returns, up to 20% monthly.

XETA Genesis's higher minimum investment aims to attract a committed user base interested in long-term, stable gains rather than speculative trading.

However, this also narrows the investor pool, potentially limiting small retail investors who are a significant part of the crypto and DeFi ecosystems.

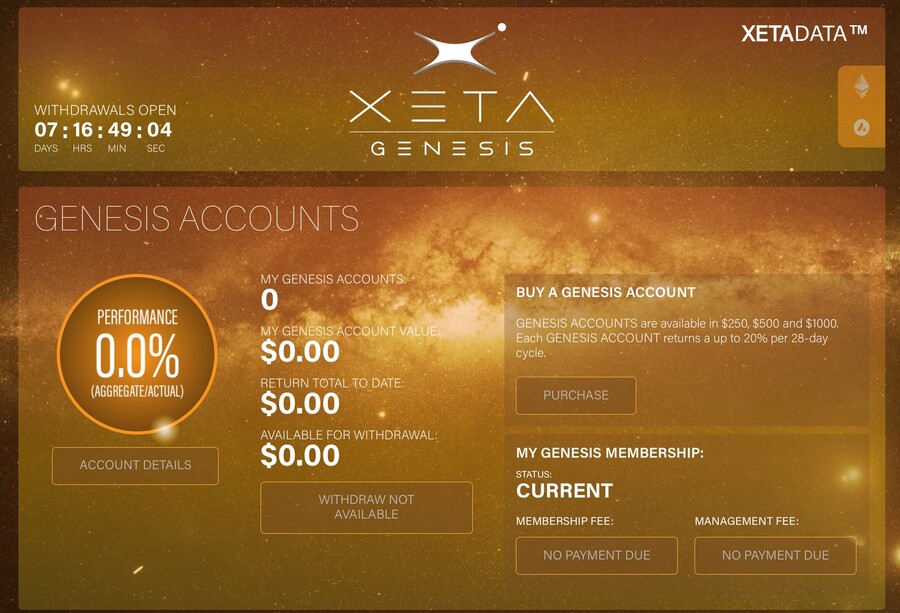

XETA Genesis UI: Dashboard Overview

XETA Genesis has an easy-to-navigate dashboard that provides a clear and simple overview of users' Genesis accounts and pools.

The XETADATA Dashboard, as a single-page interface, allows users to access features such as purchasing new accounts, paying monthly fees, and withdrawing funds during a XETA cycle. It aims to improve user experience by consolidating vital financial information into a central hub.

Additionally, the dashboard provides a historical view of withdrawals alongside detailed insights into an account's performance.

This transparency helps monitor financial activities alongside real-time data on various metrics like Membership status and reward generation, among others.

Is XETA Genesis Safe & Legit?

The domain, XETA Genesis, is associated with XETA Ltd., based in Belize. XETA Genesis is a shift from earlier phases named XETA Black and XETA Blue.

Although the founders, CEO Gavin Minty and CCO known as @Shotime2kX, are not fully doxxed, they engage with the community through YouTube AMAs and other platforms.

XETA has been operative since 2022, and testimonials from members can be found on their Discord group.

The website also contains a disclaimer, emphasizing that the information provided does not constitute financial advice and urging potential investors to conduct thorough due diligence before participating.

It also outlines a Know Your Customer (KYC), age, and sound mind policy to ensure compliance with regional legislation.

It's crucial for investors to conduct their own research and determine the platform’s legitimacy before making any committal decisions.

Customer Support

Though XETA Genesis lacks a customer support channel like a website-based live chat, it offers alternative methods to resolve your queries.

One such method is through Discord, which is monitored by a team of moderators and community members. Moreover, you can also send your queries or doubts to XETA Genesis on X (previously Twitter).

For those interested in knowing more about the XETA Genesis ecosystem, one-on-one consultations with a team member can be scheduled, offering a more personalized interaction.

Conclusion

XETA Genesis offers a blend of DeFi and TradFi, targeting consistent returns through high-frequency trading in forex and precious metals.

The platform is designed for individual and large-scale investors with options like Genesis Accounts and Pools.

The fees and withdrawal conditions vary depending on the investment route you choose. The project claims to have a track record of delivering up to 20% monthly returns and focuses on risk mitigation using stablecoins like USDC.

Nonetheless, it's vital to understand that the crypto market is highly unpredictable, so invest only what you can afford to lose.

References

- https://dune.com/riderstorm/xeta-capital-overview

- https://www.xetablack.com/_files/ugd/ac011f_c4d6ca4f84504d878027fca839a4a612.pdf

- https://www.cnbctv18.com/cryptocurrency/explained-yearn-finance-and-how-it-works-14908491.htm

- https://docs.yearn.finance/resources/risks/protocol-risks

- https://www.ecb.europa.eu/pub/financial-stability/fsr/special/html/ecb.fsrart202205_02~1cc6b111b4.en.html

- https://www.youtube.com/watch?v=ePYAMzf8120

FAQs

How does XETA Genesis work?

XETA Genesis bridges decentralized finance (DeFi) and traditional financial systems (TradFi) to offer consistent returns with lower risk. It engages in high-frequency trading, mainly in forex and precious metals markets.

Is it possible to earn profits through XETA Genesis?

Yes, it's possible to earn profits. The platform has a track record of delivering up to 20% monthly returns. However, various fees include a monthly maintenance charge for Genesis Accounts and management fees for Genesis Pools. Conducting due diligence is essential, as high returns can also carry potential risks.