How To Make Money With Crypto Arbitrage

It may have crossed your mind that these differences bring about excellent arbitrage opportunities. However, it might not be as straightforward as it looks at first glance. Let’s take a look at what is crypto arbitrage and how it actually...

If you have been in the crypto world for a while, you probably noticed the price differences between different crypto markets and exchanges. Even the most liquid digital asset Bitcoin trades at varying prices on separate markets. What's more, it may have crossed your mind that these differences bring about excellent arbitrage opportunities. However, it might not be as straightforward as it looks at first glance.

Let’s take a look at what is crypto arbitrage and how it actually works.

What is Crypto Arbitrage

In many ways, crypto arbitrage is just like fiat or sports arbitrage. The main idea here is simple: you try to benefit from price differences for the same asset on different markets or exchanges.

If you need a definition, Investopedia describes arbitrage as “the simultaneous purchase and sale of an asset to profit from an imbalance in the price. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms.”

In other words, buy low and sell high(er)!

Cryptocurrency price differentials can be substantial across exchanges. It presents traders with a legit opportunity to take advantage of price inconsistencies.

There are three distinct ways to do crypto arbitrage:

1). Regular arbitrage, which refers to buying and selling the same digital assets on different exchanges with significant price differences.

2). Triangular arbitrage, which involves price differences between three currencies on the same exchange. You try to take advantage of price differences through several conversions. For example, you buy BTC with USD, sell BTC to ETH, and convert ETH back to USD.

3. Automated arbitrage. Some companies specialize in providing tools for automated crypto arbitrage. For example, one of the leaders in this niche is ArbiSmart, which provides a quick way to deposit funds, choose a plan, and reap the benefits of automated arbitrage trading.

While all approaches are legit can be profitable, it might be more challenging to discover opportunities for triangular arbitrage within the exchange. Conversely, large volume trading on the same exchange might qualify you for attractive fee discounts that can have a positive impact on your profits. By far the easiest way to do crypto arbitrage is by using third-party arbitrage software, but then you will have to pay special attention to your service provider and how much their services cost.

For the sake of simplicity, we will use examples involving regular arbitrage below.

Why Crypto Arbitrage Might Be Lucrative

There are many reasons why you might want to try crypto arbitrage, including:

- Quick profits. If everything goes according to plan, it's a plausible way to increase your capital. At the same time, it’s all about speed so you might make money faster than with regular trades.

- A wide range of opportunities. There are more than 200 exchanges where you can buy and sell cryptocurrencies, which means a plethora of profitable arbitrage opportunities.

- Cryptocurrency markets are still young and volatile. Hence, most exchanges don’t share information and work on their own. Most cryptocurrencies experience many quick rises and sharp drops, which lead to price disparities and profitable arbitrage opportunities.

- There is less competition compared with traditional markets. Not every arbitrage trader is willing to give crypto a chance, which makes crypto space less competitive.

- Cryptocurrency price differences tend to range from 3% to 5%, and sometimes reach up to 30-50% (in extreme cases).

Needless to say, cryptocurrency arbitrage works best when you trade high amounts. Lesser amounts may result in minuscule earnings that may not be worthy of your time. Indeed, cryptocurrency arbitrage can be a highly lucrative activity, but only if you do your research, estimations, and calculations.

How To Calculate Costs And Profits Of Crypto Arbitrage

Every case is somewhat different, but typically you will need to consider the following fees:

- Maker and taker fees at the purchase exchange (exchange 1).

- Transaction (withdrawal) commissions (1).

- Deposit fees at the selling exchange (exchange 2) (if there is any).

- Maker and taker fees at the sale exchange (2).

- Final withdrawal or “cashing out” fees (2).

Besides, there are few other variables you might want to take into account:

Market volatility. Some coins fluctuate more than others, and their prices might change faster than you expect.

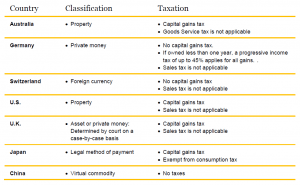

Taxes and regulations in your jurisdiction. It is easy to forget that you have to pay taxes on your crypto trades. Although the rules vary in different domains, you may want to estimate the amount of taxes you will need to pay per trade when calculating arbitrage costs and potential profits.

Example: Let's say you see an opportunity involving fiat to crypto pair. For instance, Bitcoin trades at $3821 on Bitstamp but sells for $4032 on Bitfinex. The price difference between the exchanges is $211. If you have enough funds to buy 5 BTC, you can earn up to $1055. If you have deposited your funds to Bitstamp via SEPA transfer (takes approx. 2 days) you have incurred a 0% deposit fee (international wire costs 0.05%) Next, you will pay approx. $47.7625 (let’s round it to $50) in charges (0.25%) on 5 BTC purchase. Fortunately, the withdrawals at Bitstamp are free, too.

Usually, it will take anywhere from 20 minutes to an hour for your BTC deposit to reach Bitfinex wallet. Cryptocurrency deposits on Bitfinex are also free, so no extra charges here. Let’s say that during that one hour the BTC price on Bitfinex has dropped (in the worst case scenario; it can also increase) 5% and now you can sell it for only $4010. It leaves you with a potential profit of $943. Finally, let’s say you pay the takers fee of 0.2% (0.01 BTC) of Bitfinex to sell your 5 BTC, which leaves you with $20,009. If you deduct all the costs and fees, this leaves you with approx $895 in profit.

Depending on your situation you might decide to continue trading or withdraw the money which, based on your choices, will incur extra fees ranging from 0.1% to 3%. Also, keep in mind the tax consequences for your trade.

All in all, it is safe to estimate that you will pay anywhere between 3% and 15% of your capital for fees; therefore, you should enter only the most profitable opportunities.

How To Select Exchanges For Crytpo Arbitrage

Once you decide to take advantage of crypto arbitrage, you need to evaluate and register on the most advantageous crypto exchanges. Some exchanges, like Bitfinex, require you to get your account verified (which takes approx. 6-8 weeks) and a minimum deposit of $10,000 to start trading. Others are less strict in their methods, yet, most of them will ask you to pass KYC/AML.

The most critical variables when choosing an exchange for crypto arbitrage are:

Fees. High or low trading, deposit or withdrawal fees can make or break the deals. Go for low fee exchanges whenever possible.

Geography. Some exchanges or some of their features may be restricted or limited in your area, so you need to be aware of it before making a trade.

Reputation. See what reviews and other people are saying about certain exchanges before you deposit your funds. There are many shady and unregulated platforms in the industry, so it is better to play it safe than sorry.

Transaction times. Some blockchains allow for quick transactions, while others can up to an hour or more during peak times.

Withdrawal times. Some exchanges make manual fund withdrawals which occur only once a day or so, so be aware and understand the rules before entering one.

Account verification. Some exchanges may not allow you to withdraw funds or fully use the markets before you verify your account, which can take several days or even several weeks at a time.

Market liquidity. Not every exchange has enough liquidity, especially if you’re looking to buy or sell large quantities of digital assets.

Wallet maintenance. Most arbitrage opportunities occur due to wallet maintenances in certain exchanges, so make sure to be aware of whether you can withdraw or deposit the crypto assets of your choice.

Check out our exchange reviews section when looking for the best trades. Once you set up exchange accounts and get your funds ready, it is time to make your first crypto arbitrage profit.

Step-By-Step Crypto Arbitrage Process

A step-by-step crypto arbitrage process goes like this:

1. Discover opportunities.

Many tools can help you find crypto arbitrage opportunities.

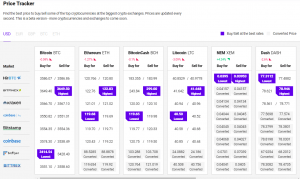

For instance, here at Cryptonews, we offer a convenient price tracker which can help you to identify crypto arbitrage opportunities between some major exchanges and cryptocurrencies.

Other handy instruments for finding arbitrage opportunities are:

- Coingapp

- Crytpo Arbitrage App

- Coinarbitrage.org

- Arbitrage.expert

- Tokenspread.com

Besides, you can take advantage of arbitrage automation programs (see the last paragraph).

2. Decide whether the opportunity is worth it.

This is the critical moment which constitutes whether you’re going to make a profit or not. It is essential to do as much planning as you can before jumping into the trade. You need to look into:

- Estimate fees: transaction, transfer, network, deposit or wallet costs.

- Research the risks: withdrawal and transfer times, market volatility, wallet maintenance, and rules or preconditions regarding exchange trades and withdrawals.

- Weigh how much of your profit will go to taxes (if applicable).

A good strategy is open, verify, and fund your accounts (both in fiat and crypto) on numerous exchanges before you spot an arbitrage opportunity. It will help you to save much precious time when executing trades. Also, at times you might want to avoid BTC transfers between the exchanges since the network known for being relatively slow and expensive, but it is an issue only when it becomes congested.

After you determine whether the exchanges and opportunities are suitable for a quick, profitable trade, it’s time to either execute it or look for another golden chance.

Arbitrage Automation Programs

Aside from manual arbitrage trading, there are platforms that offer software to help you find opportunities and execute trades automatically. They employ bots and scripts which scan certain exchanges 24/7 and can generate a profit on their own. Of course, they come with a fair share of risks, too, so you have to be careful not to play with the money you can’t afford to lose.

One of the best automated crypto arbitrage companies is an EU regulated ArbiSmart, which offers investors different plans starting from mere 500 euros.

Several interesting companies operating in the sphere are Arbitao, Haasonline Software, Gekko, and Gimmer.

Hopefully, this guide has taught you what cryptocurrency arbitrage is and how to do it. Mind that cryptocurrency trading is highly risky, and you should never risk money you cannot afford to lose. After all, it is you who have to bear responsibility for your decisions and research.

If you would like to learn more about cryptocurrency arbitrage, check out this cool writeup by Alex Lielacher.